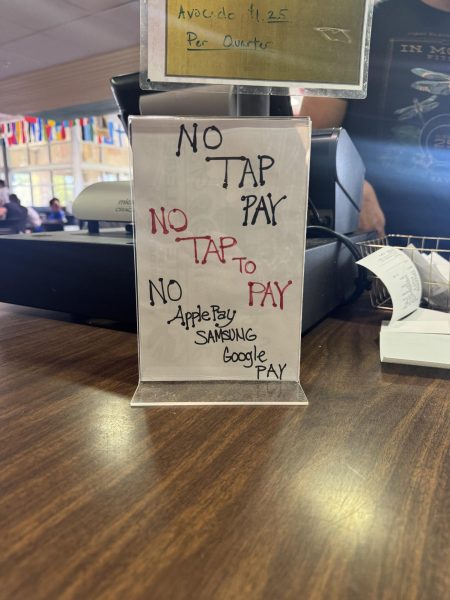

Most of us here at Butte have walked up to the register to pay, food in one hand, phone in the other, only to see the big sign stating “No tap to pay.” We then are scrambling into our backpacks, searching to see if we even have our card with us, and holding up the line.

One of many signs in the cafeteria showing that Tap To Pay is currently not an option, September 10th, 2024. Photographer: Gracie Trotti

Those days will soon be behind us as Butte is projected to get new POS systems in both the cafeteria and Wired Cafe, within the next three months. These new systems will have the option of tap to pay, making the lives of both students and faculty much easier.

Butte College Public Relations Officer, Christian Gutierrez, explained how time consuming this process has been, with finding vendors and contracting with them. While this process is time consuming, it will actually save the institution money in the long run. Gutierrez explained that while this new feature will likely increase sales, the motive behind the change is “all about making things more accessible to students.”

Gutierrez’s comment sparked the question of how Tap-to-Pay has changed the rate of consumerism in America. Research claims that “Consumers tend to spend about 10% more when they adopt mobile contactless payment methods,” according to Michael Radcliffe on the NPR podcast.

Tap-to-Pay is a double edged sword; while on one hand it’s convenient, on the other hand it can lead to unhealthy spending. In today’s society, making things more convenient and effortless is what’s important to most. However at what cost? Is the convenience of Tap-to-Pay worth the mindlessness that it causes within our spending?