We all know the common expression “starving college student,” and this essay covers its exact origin. Many college students suffer from unprepared spending sprees and unnecessary expenses. This results in food shortages, unpaid bills, and restrictions on school appliances. The problem is that college students don’t understand how to budget to survive college properly.

Most college students prefer to buy the newest iPhone model or splurge on a spending spree at Target. It’s hard to understand needs over wants when first starting as a college student. There are fewer restrictions, and no one to advise you not to spend money on the name brand when the store brand will do just fine.

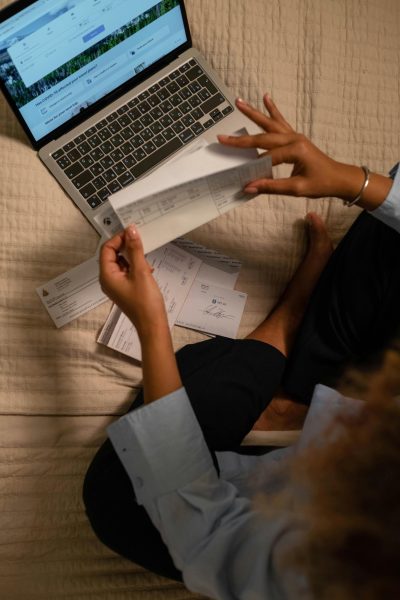

I have found myself in this position many times. “Maybe I’ll buy 30 dollars of groceries and the rest on entertainment and a new pair of jeans!” However, 30 dollars worth of food does not make the cut and I forget my other expenses such as gas, personal appliances, insurance, etc. Even though going to the movies and American Eagle sounds so much more appealing I am now learning I need to start budgeting for my daily college life expenses if I want to survive.

College students will spend their money irresponsibly at first.

In her article “College Students, Take Note: Develop Good Spending Habits and Secure Your Future” the manager editor for The Vector Impact, Anna Schmohe states, “Each year, college students spend around $2.4 billion in total on entertainment purposes.” In this same survey, she also found that “59% of college students spend on live shows while 57% of them spend money on other forms of entertainment.” This helps represent just how much money college students spend on entertainment alone.

As we can see college students spend their money on experiences and materialistic items over purchasing what they need to survive; however, there is a way to have your cake and eat it too.

The answer to our major problem is budgeting! Budgeting sounds scary to most college students but really it is super easy and only takes a couple of steps.

The article “The Student’s Guide to Budgeting in College” by certified financial planner, R.J. Weiss, creates a helpful guideline for college budgeting. The guideline goes as follows,

- Step 1: break down your total income,

- Step 2: assess and categorize your expenses

- Step 3: crunch the numbers

- Step 4: create a college student budget

Weiss then goes further by providing helpful tips such as meal prep, shopping at thrift stores, using student discounts, and more. Weiss believes that these four easy steps along with his advanced tips can help make a great change to a college student’s financial struggles. However, does this advice help?

I first added up my work income for one month and added any financial add that would come in the same month. Afterward, I organized my necessary expenses such as car insurance, phone bills, food, and gas. Next, I categorized my unnecessary expenses such as holidays, outings, and coffee runs. Once I finalized the total it was time to crunch the numbers. By sacrificing coffee runs, shortening outings, and coming up with a built-proof meal prep I was able to create a college student budget that worked for me. So I can say truthfully Weiss’s method does work with the right dedication.

In conclusion, it can be inferred that college students’ financial struggles can be solved by budgeting. The thrill of a shopping spree or a fun outing to the roller rink may seem perfect at the moment. However, your life expenses are at risk when these courses are taken. Budgeting will take hard dedication and sacrifice but it is most certainly worth it in the end.